Conveyancing News from Brisbane & Queensland

Brisbane

First Home Buyers Update 2025

What Albanese’s Re-Election Means for First Home Buyers in Queensland

As leading conveyancing lawyers in Brisbane, River City Conveyancing is committed to helping home buyers understand the legal and financial landscape, especially as policies evolve. With the re-election of the Albanese government in 2025, there are several major proposed changes that could affect first home buyers in Queensland.

If you're planning to buy your first home, here’s what you need to know and how these proposed chan.....

Read more

House Insurance After Contract Signing

House Insurance After Contract Signing: A Vital Step in Queensland Conveyancing 2025

When purchasing a home in Queensland, securing the right house insurance is an important yet often overlooked step in the conveyancing process. It’s not just a formality—it’s a key factor in protecting your investment and ensuring peace of mind. Many buyers may not realise the importance of having insurance in place immediately after signing the contract. Here's everything you need to know about house insurance .....

Read more

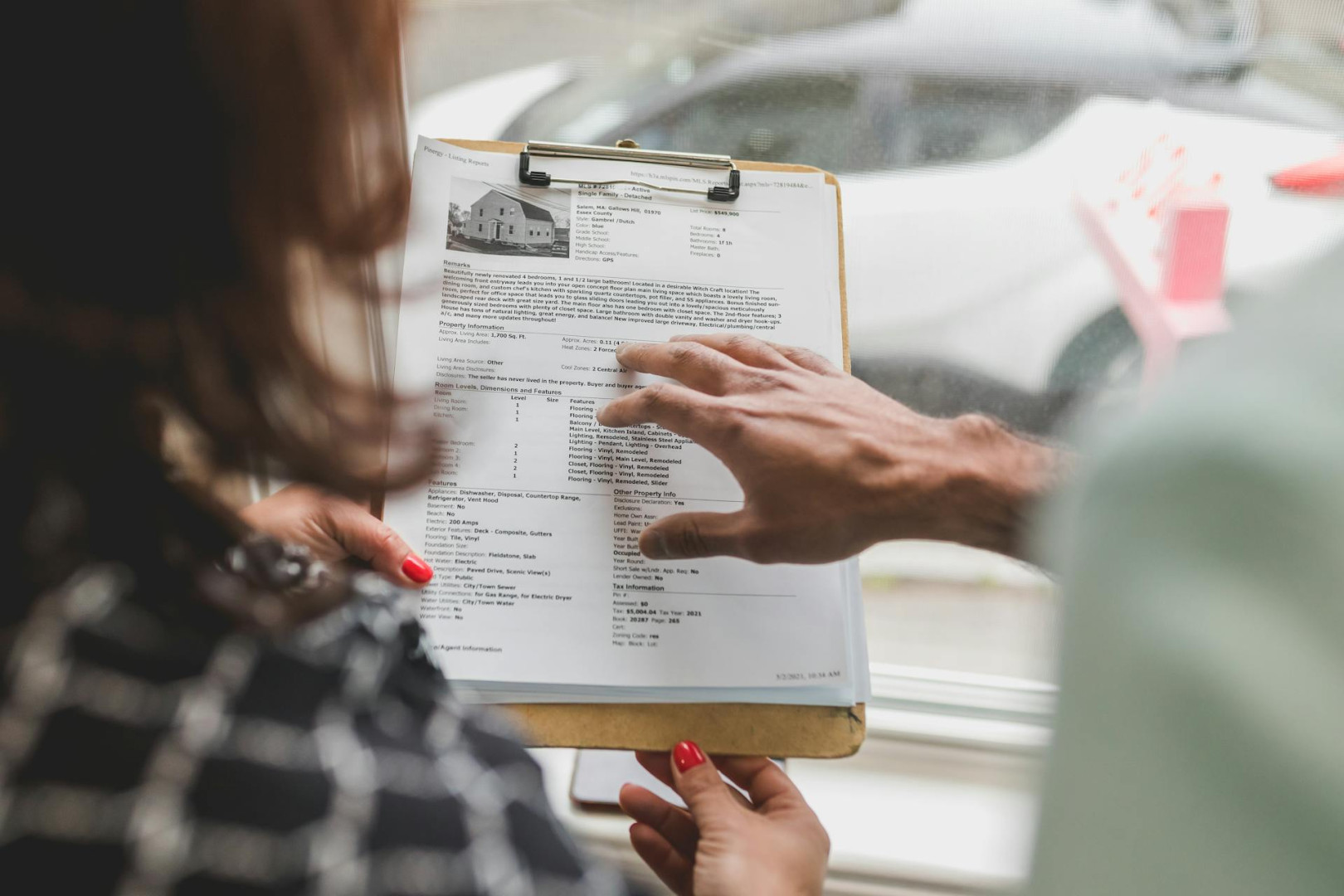

How to make an offer on a property

How to Make an Offer on a Property in Queensland: A Step-by-Step Guide

Making an offer on a property in Queensland is a significant step in the home-buying process. Whether you’re purchasing through a private sale or at auction, understanding how to make an offer effectively is essential. Here’s a comprehensive guide to help you navigate the process, along with some key considerations to ensure you’re making an informed decision.

Making an Offer in a Queensland Private Sale

1. How to Make an Off.....

Read more

Can you Sell without an Agent?

Can You Sell Your House Without an Agent in Queensland? A Complete Guide for Homeowners.

Thinking of selling your property in Queensland without using a real estate agent? You’re not alone. Many homeowners are exploring the option of selling privately to save on commission fees or to maintain more control over the sale process. But can you actually sell your home without an agent in Queensland? And if so, what steps should you take to ensure a smooth transaction?

River City Conveyancing solicito.....

Read more

Queensland Seller Disclosure Laws

The introduction of the new Statutory Seller Disclosure scheme marks a significant change in Queensland’s conveyancing landscape. With the passing of the Property Law Act 2023, Queensland will implement in 2025 a formal Seller Disclosure scheme for residential land transactions.

Previously, Queensland had no formal requirement for sellers to disclose property defects or issues, placing the onus solely on buyers to conduct their own searches. However, the new Seller Disclosure scheme will require.....

Read more

Top 5 Mistakes to Avoid When Selling a House in Brisbane, Queensland

Top 5 Mistakes to Avoid When Selling a House in Brisbane, Queensland

Selling a house in Brisbane, Queensland, involves a multistep conveyancing process with many legal and financial considerations. Whether you're upgrading, downsizing, or relocating the most critical aspect of selling a property in Queensland is conveyancing, which ensures the legal transfer of ownership is carried out smoothly.

However, many sellers make avoidable mistakes that can lead to delays, added costs, or legal complica.....

Read more

Conveyancers Both Buyer & Seller

Why Your Conveyancing Solicitor Shouldn’t Represent Both the Seller and the Buyer in Real Estate Transactions in Queensland.

Across Australia there are no laws preventing Conveyancing Solicitors from acting on behalf of both the Buyer and Seller in a property conveyance. However there are significant risks involved if there are any disputes or complications during the property transaction.

When a solicitor takes on the role of representing both parties in a property transaction, they are require.....

Read more

Brisbane House Prices & the Queensland Market 2024

Five Updates for Queensland Buyers & Sellers of House and Land

1. Queensland Population Growth & Housing Supply

A marked imbalance between housing supply and demand in the sunshine state has been observed due to various factors throughout 2023 and into 2024. According to the Australian Bureau of Statistics, Queensland has seen the highest level of interstate migration in the country from the start of 2023 to September. ‘Queensland welcomed about 110,000 interstate movers, and data.....

Read more

First Home Guarantee Scheme Queensland Guide 2024

What is the First Home Owners Guarantee Scheme (FHBG) in Queensland 2024?

The First Home Guarantee (previously called the First Home Loan Deposit Scheme FHLDS) is available for eligible purchasers of their first home to get into the property market by paying only a 5% deposit on their mortgage with the Queensland Government’s Aid. It is organised by Housing Australia on behalf of the Australian Government. It is referred to as the FHBG.

What are the benefits of the FHBG?

The scheme offers three .....

Read more

Sunset Clause in Queensland

Queensland Conveyancing News: Sunset Clause Crackdown

The Queensland government has taken decisive action to address conveyancing transaction concerns by cracking down on the misuse of the sunset clause in off-the-plan contracts. These contracts, whereby the property is purchased before the construction on the land is complete have become controversial due to the problematic practice involving developers and the sunset clauses. In the past, instances occurred where developers, using sunset claus.....

Read more

Finance FAQs & Conveyancing

Finance Timeline FAQs for Conveyancing when Buying a House or Land in Queensland

When are Conveyancing fees payable in Queensland?

Conveyancing fees are not required to be paid in advance. Payment for the services provided by River City Conveyancing is made through a deduction at settlement. There are no upfront or advance fees necessary.

Read more about Conveyancing Costs

What is the typical timeframe for purchasing a house in Queensland?

The Conveyancing process commences upon the signin.....

Read more

Land Tax Valuations Qld Conveyancing

How valuations affect Land Tax in Qld?

When it comes to buying or selling land in Queensland, it's important to consider the financial implications for land tax. While your assessment already takes your land tax liability into account, there are situations where land tax may also be payable during property transactions. River City Conveyancing solicitors have been taking care of Queensland conveyances for over 30 years and offer premium conveyancing services at an affordable price. Our local con.....

Read more

Flood buyback for homeowners in Queensland

The newly introduced Resilient Homes Fund through the Commonwealth-State Disaster Recovery Funding Arrangements (DRFA) is offering a buyback of homes impacted by floods in the Queensland state.

Federal Minister for Emergency Management Murray Watt commented that it was a great outcome for the homeowners involved. “Every property we can buy back through this program is a win for disaster resilience in Queensland and another step in ensuring we are better prepared for the next flood. These Queensl.....

Read more

Can You Lose your Deposit when Buying a New House

In Queensland the controversial terms of contract that allowed property Sellers to keep the deposit of Buyers if settlement is not completed has now been changed. The REIQ has initiated the introduction of a new terms of contract in the standard REIQ contract used in Queensland.

Originally all REIQ contracts were considered to be ‘time of the essence’ meaning that all conditions of the contract must be fulfilled by the agreed upon times and dates as written in the signed contract.

Previously any.....

Read more

Contract Termination

Can you change your mind after buying a house?

If you are ready to buy residential property in Queensland or in the process of signing a house and land contract it is essential that you know exactly what you are getting yourself into.

Conveyancing is rarely straight forward therefore it is best to contact a qualified property solicitor to safely navigate you through the process and avoid any costly mistakes or misunderstandings.

River City Conveyancing is one of Brisbane’s most trusted Con.....

Read more

Digital Auctions

Conveyancing Update: The emerging digital auction market in Queensland

Due to on-site and in-room auctions now being banned across Australia following Scott Morrison's announcement during the COVID-19 lockdown a new emerging digital market for auctions has come to the fore.

The last month has shown that the Australian real estate market is adapting in some respects to these uncertain times. Although some buyers will withdraw from the market or opt for private sales there has been increasin.....

Read more

Special Condition COVID-19

IMPORTANT NOTE – COVID-19 PANDEMIC:

Due to the current COVID-19 Pandemic we advise that if you are signing a contract as a Buyer or Seller of property or land in Queensland to include in your contract the COVID-19 Special Condition

Conveyancing during the Coronavirus Pandemic

As you are aware, the COVID-19 Pandemic is having an unprecedented impact worldwide. It may have a significant effect on your conveyance and for that reason, you should consider the following matters:

The current COVID.....

Read more

Steps for Signing a Contract

Steps to Signing a House and Land Contract in Brisbane

If you are considering a move to the sunshine state you might already have a few questions regarding how conveyancing works in Queensland in comparison to Victoria or the other Australian states.

Property conveyancing is the transfer of property or land titles from a seller to a buyer. This involves more than just an exchange of contracts, as under Queensland law there are many steps that need to be completed before a property transaction is.....

Read more

Home Insurance

When do you need to organise home insurance on a new house?

If you have newly signed a contract for the purchase of a house or property in Queensland it is imperative to know from what time you will be responsible for the loss or damage to the property. As the bushfire crisis in Australia continues across Summer and into 2020 we strongly advise that you find out as you sign a new contract by speaking with a conveyancing solicitor.

House and land contracts will sometimes move the responsibility o.....

Read more

Stamp Duty Qld : How to Calculate Transfer Duty on Multiple Transactions

How much is Stamp Duty In Brisbane?

Combining Dutiable Transactions

The transfer duty on multiple dutiable transactions must be added together and treated as a single transaction. These transactions can only be combined however when they are ‘related’ - meaning they form one arrangement or are ‘aggregated’ based on certain factors.

Aggregation of dutiable transactions is compulsory under section 30 of the Duties Act 2001.

When adding transactions the transfer duty is calculated on the total cons.....

Read more

Conveyancing Finance Approval Help for Buyers

We’ve compiled our conveyancing buyer's information for finance approval but don’t hesitate to contact us today if you’d like a fixed quote for your new conveyancing contract in Queensland. Don't overpay for conveyancing, our dedicated Brisbane based conveyancing solicitors can help you through the conveyancing process without any hidden extra costs.

Conveyancing Finance Approval Help for Buyers

Get pre-approval. Have an idea of how much you can borrow before you sign your contract by speaking .....

Read more

First Home Loan Deposit Scheme

The First Home Loan Deposit Scheme (‘FHLDS’) was announced during the recent Federal election.

The new rules state that first time buyers need now only save a 5% deposit when they purchase a new property. Currently most banks and financiers require a 20% deposit before they will consider providing finance for the purchase of a residential property.

The FHLDS will guarantee loans through the National Housing Finance and Investment Corporation.

Not only will it mean that First Home Buyers do not h.....

Read more

Queensland First Home Owners’ Grant

The Queensland first home owners’ grant is a state government initiative to help first owners to get their new first home sooner. Depending on the date of your contract, you’ll get $15,000 or $20,000 towards buying or building your new house, unit or townhouse (valued at less than $750,000). You can even buy off the plan or choose to build yourself. It’s a great opportunity to buy or build a new home in our great state.How a Queensland First Home Owners’ Grant Can Help YouIf your thinking of buy.....

Read more

Confused about how conveyancing works?

For first time home and apartment buyers in Brisbane we often get calls about how conveyancing works and what is the process for conveyancing Brisbane.We have put together this great page on our web site that shows the steps in the process for your easy understanding.Visit the page about how conveyancing works in Brisbane.Read more: How conveyancing works

Read more